Lately, you may have frequently seen headlines about the 'RAM Crisis' in technology news, or been surprised by the exorbitant prices you encountered when investing in a new computer/server.Many people simply explain this situation away with 'the dollar exchange rate' or 'global inflation'.

However, as a Logistics Management student, when I examine the data, I see that the picture is much more complex.What we are facing is not simply a price increase;it is a global Supply Chain Disruption extending from production to distribution.

In this analysis, we will not only look at price tags, but also examine the logistical root causes of the crisis, from Google's demand shock to the production constraints of the Dutch giant ASML.

The Origin of the Crisis

While artificial intelligence (AI) has recently become an indispensable part of our daily lives, it has also brought with it unprecedented hardware costs. The RAM crisis we are experiencing today is fundamentally rooted in this 'Computational Power Inflation'.

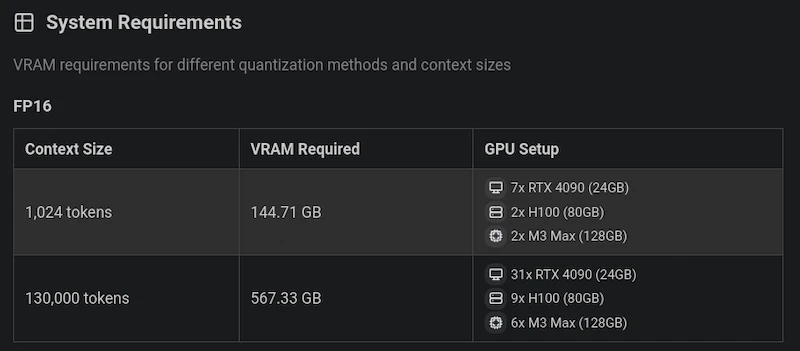

To illustrate this relationship, let's examine Llama 3.3 (70B), one of the most popular open-source models currently available for local computer use. To download and run this model at industrial standards (FP16), i.e., at full performance, you need a massive 144.71 GB of VRAM. This figure is equivalent to using seven Nvidia RTX 4090 graphics cards, the most powerful graphics card you can buy as a consumer.

When you multiply the enormous resources required for a single model by the billions of users, the scale of the crisis becomes clear. Indeed, Google's recent warning to its employees, "To keep up with current demand, we need to double our capacity every six months" confirms this. In short, the root cause of the crisis is that giants like Microsoft and Google have vacuumed up all the available memory stock on the market to run these massive models, leaving no capacity for end users.

The Current State of the Crisis

To understand the severity of the crisis, it's enough to set aside theoretical calculations and look at the latest developments on the ground. News from the sector shows that the disruption in the supply chain has affected even the giants of 'Vertical Integration' (self-producing companies).

Samsung's Internal Supply Crisis

For example, it has been reported that Samsung, one of the world's largest technology manufacturers, is having difficulty sourcing RAM from its own group company, Samsung Memory, due to rising costs and supply constraints. This scenario, where a company cannot obtain goods from its own factory, is the clearest evidence of bottlenecks in logistics processes.

The primary reason here is purely financial strategy: Instead of giving its limited chip inventory to its own mobile department with a 'sibling discount', Samsung Memory prefers to sell them to large external customers with much higher profit margins.

Farewell to the Consumer, Hello to Artificial Intelligence: Micron's Radical Decision

However, the shocking news for end users came from memory giant Micron. The company decided to completely shift its factory capacity to meet the demand from AI servers (B2B). As a result of this strategy, it announced that it will end end-user operations of its Crucial brand, which we have used in our computers for years.

These two events scream one thing: manufacturers are now choosing to use their limited capacity for giant clients like Google and Meta, rather than for us (end users). The consumer electronics market has been removed from the supply chain's priority list.

Why Isn't Production Being Increased?

You may have heard that the biggest RAM manufacturers are giants like Samsung or SK Hynix. But when we examine the business from a supply chain perspective, we see that these giants source the highly technological and costly machinery they use to produce RAM and processors from the Dutch monopoly ASML.

The Bottleneck That Technology Giants Are Subjected To: ASML

This means that companies looking to increase their RAM production capacity should first approach ASML. However, the Dutch giant announced in its 2025 report that it will not increase its production capacity in 2025 and will produce the same number of machines in 2025 as it did in 2024. Instead of increasing the number of machines, they opted to increase their speed.

One reason for this is that ASML also sources critical parts used in machine manufacturing from a single supplier. Furthermore, as they stated in the aforementioned report, they said they "cannot predict the future" for 2026. The reasons for this statement are the ongoing trade wars between the US and China and the Russia-Ukraine conflict.

Critical Raw Material Bottleneck: Neon and Palladium

The Russia-Ukraine war is also disrupting the supply chain for neon gas, which is critical for RAM and chip production. The two largest neon gas purification companies are located in Ukraine, and the ongoing war is impacting production. Furthermore, Russia controls a very large portion of palladium, also widely used in chip production, and nickel, used to produce C4F6 gas. On top of all this, helium, another inert gas heavily used in chip production, is also globally scarce.

Invisible Barrier: Engineer Shortage and Construction Timelines

Even if you overcome all the obstacles mentioned above, a new problem awaits you: a shortage of skilled labor. According to a report published by McKinsey & Company, there is a shortage of qualified process engineers to operate the facilities being built. It is predicted that there will be a shortage of more than 100,000 engineers in the US and Europe, and more than 200,000 in the Asia-Pacific region.

At the same time, even if you find engineers, you will have trouble finding qualified labor to work on the factory construction. Because these factories are not standard buildings; they have to be built to 'Cleanroom' standards, with nanometric precision.

Finding skilled workers isn't the only problem; construction times have also doubled compared to the past. While it used to take two years for a factory to go from foundation to production, now, due to increasing technological complexity (EUV machines, etc.) and material supply issues, this period extends to three to four years.

Barriers to Entry in the Industry

In the preceding part of this article, we detailed why building a factory from scratch is nearly impossible and why the costs are so high. But you might be wondering: 'What about the giant brands we see in stores, like Asus, Corsair, or Kingston? Don't they produce RAM?'

Let's answer from a logistics perspective: Technically, no, they don't produce them.

These companies are not 'Chip Manufacturers', but 'Module Assemblers'. This means they buy silicon chips the brains of RAM from Samsung, SK Hynix, or Micron; assemble them onto green circuit boards (PCBs), attach their own heatsinks, put their brand on them, and sell them.

You might say, 'Then I'll buy chips and create my own brand.' That's where you run into the "Supplier Relationship Management" (SRM) obstacle. During times of crisis, major manufacturers like Samsung always prioritize allocating supplies to strategic partners like Asus or MSI, with whom they've collaborated for years. It's impossible for a newcomer, even with the money, to gain a share of these giants' supply chains.

The Second Front in the Capacity War: The Automotive Sector

So far, we've mostly talked about artificial intelligence and the supply chain crisis. But according to TrendForce's 2025 report, the crisis will deepen even further. The main reason for this is cars. The report states that the automotive semiconductor market will approach $100 billion in 2029 and will show an annual growth rate (CAGR) of 7.4%.

You might be surprised to hear about cars amidst the crisis. But consider the example of Tesla, which is quite popular in our country; one of the brand's biggest marketing points is its autonomous driving features. We are rapidly approaching a future where cars will cease to be simple 'four-wheeled transportation vehicles' and become 'four-wheeled computers and data processing centers'.

For vehicles to be able to drive autonomously, they need to analyze data from cameras and Lidar sensors in real-time. This process requires very high processing power, which naturally increases the RAM needs of the automotive industry.

Another critical shift in logistics is that car manufacturers are now negotiating directly with foundries instead of 'Tier 1' suppliers like Bosch. This means that car manufacturers like Ford are now queuing up with tech giants like Google for RAM stock, alongside other companies seeking capacity.

Future Projection

Another development that further darkens the future projections comes from hardware giant Nvidia. According to leaks reported by PCGamer, Nvidia plans to stop packaging and selling its next-generation laptop GPUs (especially the RTX 50 series) with VRAM.

In logistics terminology, we call this 'Risk Transfer'. Previously, Nvidia used its enormous purchasing power to acquire VRAM cheaply from memory manufacturers (Samsung, Micron), combine it with GPUs, and sell it as a ready-made package to laptop manufacturers (Asus, MSI, Dell). However, Nvidia is now preparing to shift the risk and cost of VRAM supply onto laptop manufacturers.

When we combine all this data, the picture that emerges for 2026 and beyond is unfortunately not very encouraging for the end user. A TrendForce report dated December 18, 2025, published while I was writing this, confirms this situation with clear data.

According to the report, in the past there was a 4-5 times price difference between AI memory (HBM) and standard RAM (DDR5). However, by the end of 2026, this difference is expected to decrease to 1-2 times. This will not be because HBM has become cheaper, but because standard RAM (DDR5) has become excessively expensive as factories shift their capacity to HBM.

With Micron exiting the consumer market (Crucial), Samsung being unable to supply goods domestically, and ASML facing production limitations, we may be heading towards a period where 'you can't find products even if you pay for them'.

In conclusion, while artificial intelligence and autonomous vehicles will make our lives easier, accessing the hardware that powers these technologies will no longer be as cheap and easy as it used to be. In this 'Capacity War' in the supply chain, unfortunately, we consumers are the weakest link.

References and Further Reading

TrendForce: Higher DDR5 Profitability Intensifies Capacity Crowding

TrendForce: Automotive Semiconductor Market Forecast 2029

McKinsey & Company: Semiconductors: Barriers to Scale

PCGamer: Nvidia Laptop GPU VRAM Bundling Leak

- Ars Technica: Google Must Double Capacity Every 6 Months for AI Demand

- PCWorld: RAM is So Expensive Samsung Won't Sell it to Samsung

- Micron Technology: Micron Announces Exit from Crucial Consumer Business

- Lesico:The Bullwhip Effect on the Semiconductor Industry